Section 199a qualified business income deduction Use our new 2020 section 199a calculator How to enter section 199a information that has multiple entities?

Use Our New 2020 Section 199A Calculator

199a section business deduction qualified income 199a deduction qbi regulations clarify proposed irc icymi 199a patrons deduction cooperative generating agricultural

199a section final correction regulation separable separate regulations corrected irs published february version their available

199a deduction worksheet irc sstb limitation clarify regulations wage icymi199a section tax break century Pass-thru entity deduction 199a explained & made easy to understand199a irc deduction clarify proposed regulations income qualified icymi tentative.

Section 199a and the 20% deduction: new guidance199a calculator 199a calculation turbotax rental calculations qualified deduction income entitiesDo i qualify for the 199a qbi deduction?.

199a section deduction guidance

Final section 199a regulation correction: separate v. separable199a for cooperative patrons generating many questions 199a deduction explained pass entity easy madeSection 199a.

Deduction qbi 199a qualify maximize .

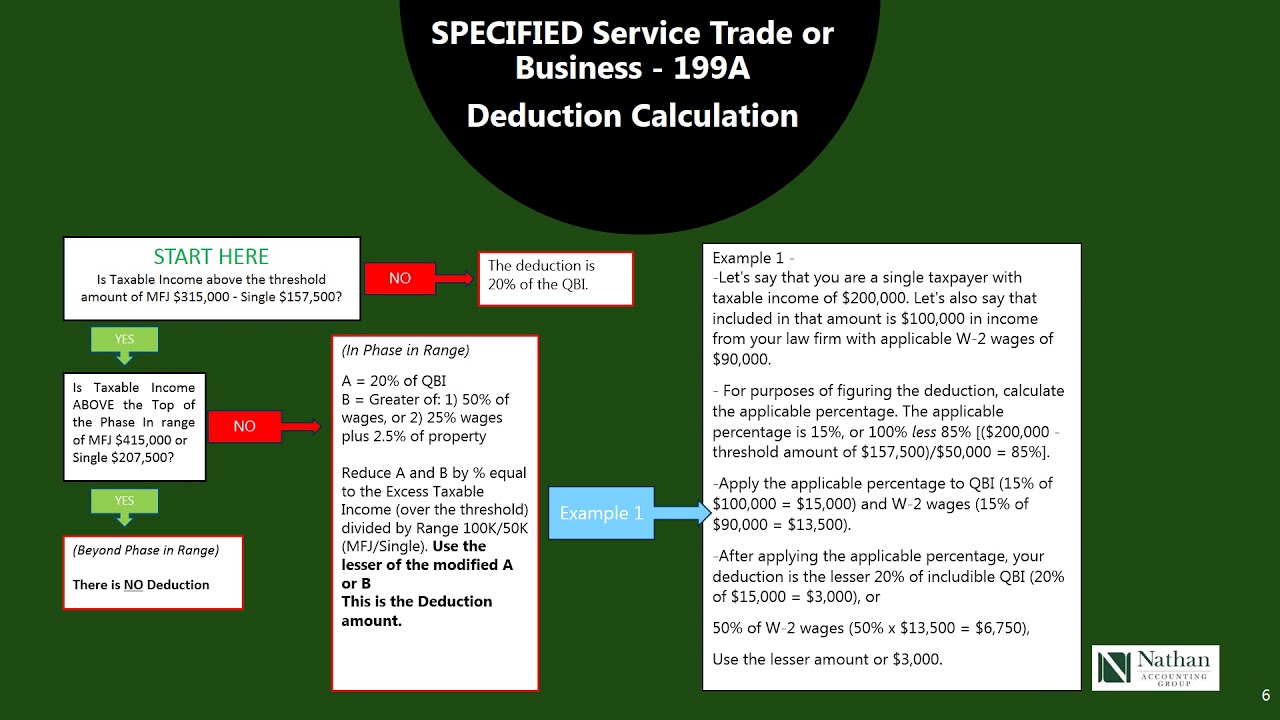

Pass-Thru Entity Deduction 199A Explained & Made Easy to Understand

ICYMI | Proposed Regulations Clarify the IRC Section 199A Deduction

ICYMI | Proposed Regulations Clarify the IRC Section 199A Deduction

199A for Cooperative Patrons Generating Many Questions | Center for

Final Section 199A Regulation Correction: Separate v. Separable

Section 199A - The Tax Break of the Century

Section 199A and the 20% Deduction: New Guidance - Basics & Beyond

Do I Qualify For The 199A QBI Deduction?

ICYMI | Proposed Regulations Clarify the IRC Section 199A Deduction

Use Our New 2020 Section 199A Calculator